Gold Market Analysis: Trade Policy Uncertainty Weighs on Precious Metals

Video section is only available for

PREMIUM MEMBERS

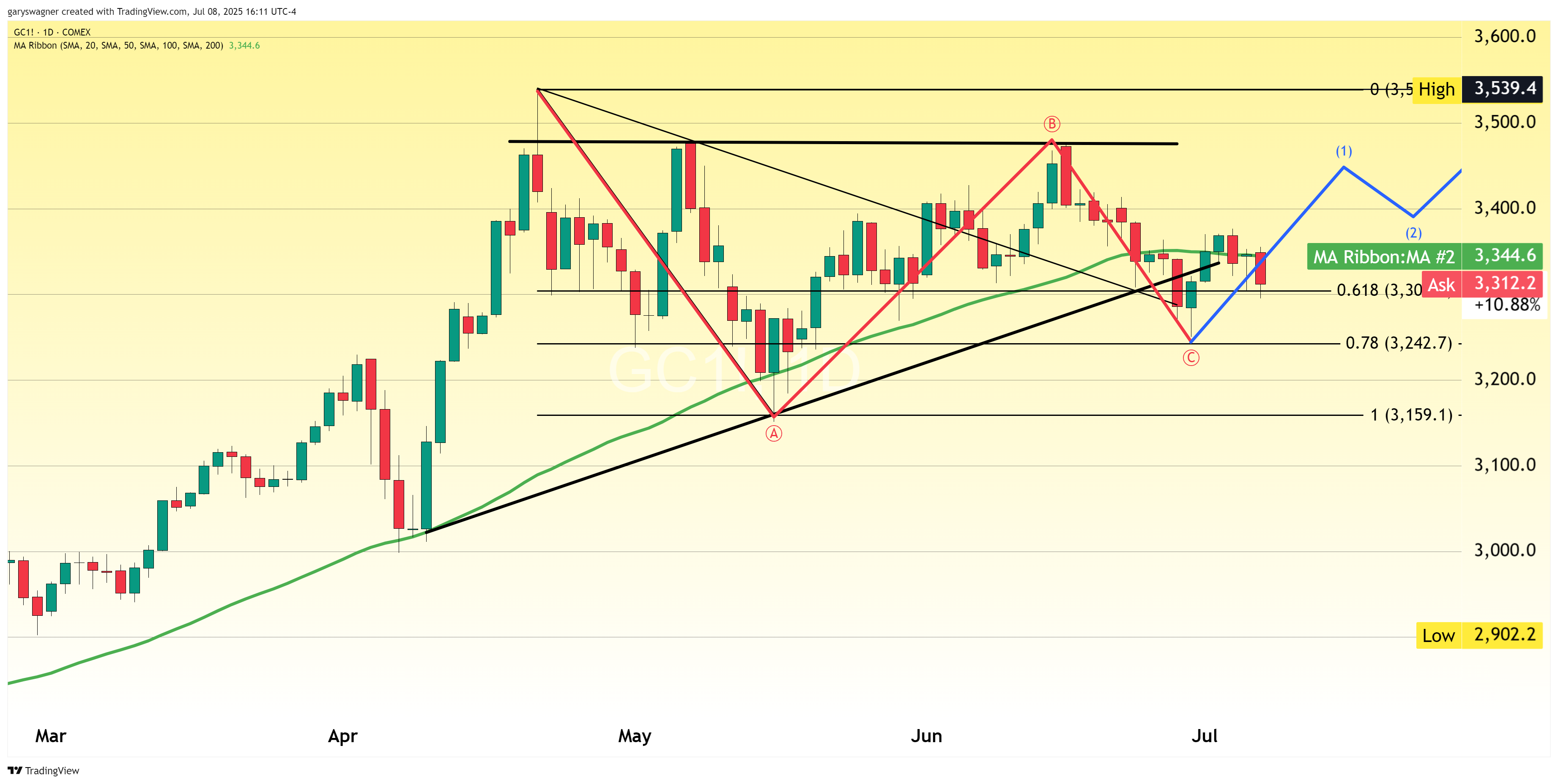

Gold prices extended their decline for a second consecutive session, establishing a third straight lower low beneath the tentative support level of $3,300. As of 3:15 PM ET, Comex gold futures were trading down approximately $29, or 0.85%, at $3,314 per troy ounce. The precious metal's recent weakness coincided with mixed signals from currency markets, as the US dollar index held steady at 97.50 after gaining ground in yesterday's session, and initial strength earlier in the day.

Equity markets reflected the broader uncertainty permeating financial markets, with the Nasdaq composite managing modest gains while both the Dow and S&P 500 moved lower. Much of this mixed sentiment stemmed from continued confusion surrounding the Trump administration's trade policy stance, particularly following the president's definitive rejection of any tariff delays on Tuesday.

Trade Policy Creates Market Volatility

President Trump's latest communications on trade policy have introduced significant uncertainty into markets. After suggesting Monday that the August 1 tariff deadline was "not 100 percent firm," Trump reversed course Tuesday with an emphatic Truth Social post declaring that tariffs would commence as scheduled. The president emphasized that formal notifications were being dispatched to affected countries and that no extensions would be granted, marking a notably firm stance that contrasted sharply with his previous flexibility.

The scope of these tariff measures is substantial, affecting major trading partners and emerging markets alike. The administration's announcement of a 25% tariff on Japan and South Korea represents a significant escalation with two of America's largest trading partners. Additional countries face varying rates, with Indonesia subject to a 32% tariff, Bangladesh 35%, South Africa 30%, and Malaysia 25%. The implications for Japan, in particular, sent the yen lower and provided some support for the dollar.

Adding to the political uncertainty, Elon Musk's proposal for a new political party dubbed "the American Party" has introduced additional variables into an already complex policy landscape. Musk's policy proposals reportedly stand in stark contrast to current administration positions, further complicating market sentiment.

Geopolitical Factors Shift

While trade policy uncertainty continues to provide some support for gold's safe-haven appeal, traditional geopolitical drivers have diminished in recent weeks. The ceasefire between Israel and Iran appears to be holding, reducing Middle Eastern tensions that had previously bolstered precious metals demand. Similarly, the Ukraine-Russia conflict has failed to maintain media attention, suggesting reduced market focus on this geopolitical risk.

Central Bank Demand Remains Robust

Despite these shifting dynamics, one key source of gold demand has remained consistently strong. Central bank purchasing continues to provide fundamental support for the precious metals market. Metals Focus analysts forecasted in their latest annual Gold Focus report that central banks would acquire 1,000 tonnes of gold in 2025. Such purchases would represent the fourth straight year of 1,000-tonne additions to official gold holdings, comprising roughly 21% of worldwide gold demand.

This level of institutional demand represents a dramatic shift in the gold market's structure. Fifteen years ago, central bank purchases constituted approximately 10% of the gold market, highlighting the growing importance of official sector demand in supporting precious metals prices during periods of market uncertainty.

Silver Markets Show Resilience

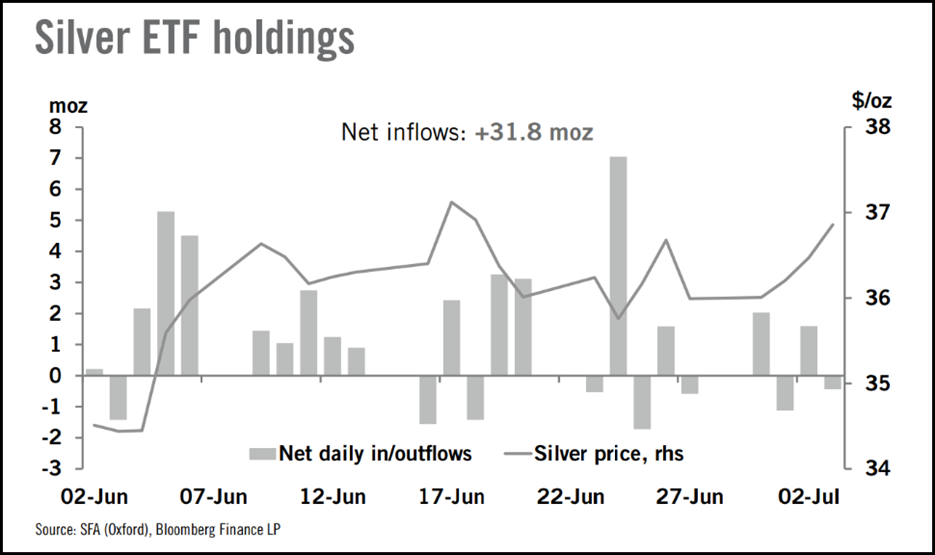

Silver markets have demonstrated notable resilience compared to gold, with futures trading essentially unchanged, down just $0.03 at $36.85. This relative strength has been supported by continued retail investor interest, as evidenced by ETF holdings rising nearly 1,000 tonnes since the start of June. While central banks focus their attention on gold, retail investors appear to be accumulating silver ETFs, helping to cushion the white metal's decline.

The gold-silver ratio remains above 90, an unusual level that many investors view as unsustainable. Historical patterns suggest the ratio should trend back toward the 10-year average in the 80s, with most analysts expecting this adjustment to occur through silver price appreciation rather than gold price declines. Recent trading patterns support this view, as gold has shown more pronounced weakness over the past few weeks compared to silver's more stable performance.

Wishing you as always, good trading,

Gary S. Wagner - Executive Producer