Precious metals overcome dollar strength from Jobs report

Video section is only available for

PREMIUM MEMBERS

00:00 - Intro: Gold Hits Record $3,800 vs. a 3.8% U.S. GDP Report

01:00 - Kitco Poll: 73% of Viewers See Gold Above $4,000

01:50 - Reviewing Gary's Last Forecast (Metals HIT, Dollar MISS)

02:15 - Gary Wagner's U.S. Dollar Analysis: Resistance at 100

04:10 - Gold's New All-Time High ($3,823): Why Consolidation is a Sign of Strength

06:15 - Has Volume Confirmed Gold's Breakout?

07:28 - Gary Wagner's Key Support Level for Gold ($3,700)

08:10 - The Fed's "Quandary": Fighting Inflation & a Weak Labor Market

12:20 - Gold's RSI Most Overbought Since 1980: Bullish or Bearish?

15:25 - Gold Price Forecast: Gary Wagner's Timeline for $4,000

16:00 - Silver Price Forecast: "A Solid Breakout Like We Haven't Seen in Years"

17:10 - Is $50 Silver

_____________________________________________________________________________________________

New jobless claims in America came in lower than expected as seen through the Jobs report released today. A poll done by the WSJ was calling for the creation of 235,000 new unemployment claims and the actual number came in somewhat lower at 218,000 new claims being added.

This reinforced the recent uptick in U.S. dollar strength which gained 0.62% in trading yesterday and matched those gains today. This puts the dollar index well above 98 at 98.483. If the dollar holds near current pricing it will represent the highest closing price this month. This represents a dramatic shift in the dollar as it had just hit its lowest trading point this month a little over a week ago when it traded to a low of 96.21 last Wednesday.

This newfound strength in the dollar was not enough to bring about a crash in the precious metals, all of which closed higher today. Gold futures gained $12 most of which came in after hours trading. This brought futures prices up to $3,780.50 up 0.32% on the day. All other precious metals rose by over 3% today with platinum futures gaining $46 or 3.10% bringing them to $1,530 per troy ounce. Palladium futures gained $43 or 3.45% moving the price to $1,283.50 per troy ounce, and silver futures gained $1.35 in trading today or 3.07% taking a troy ounce to $45.47.

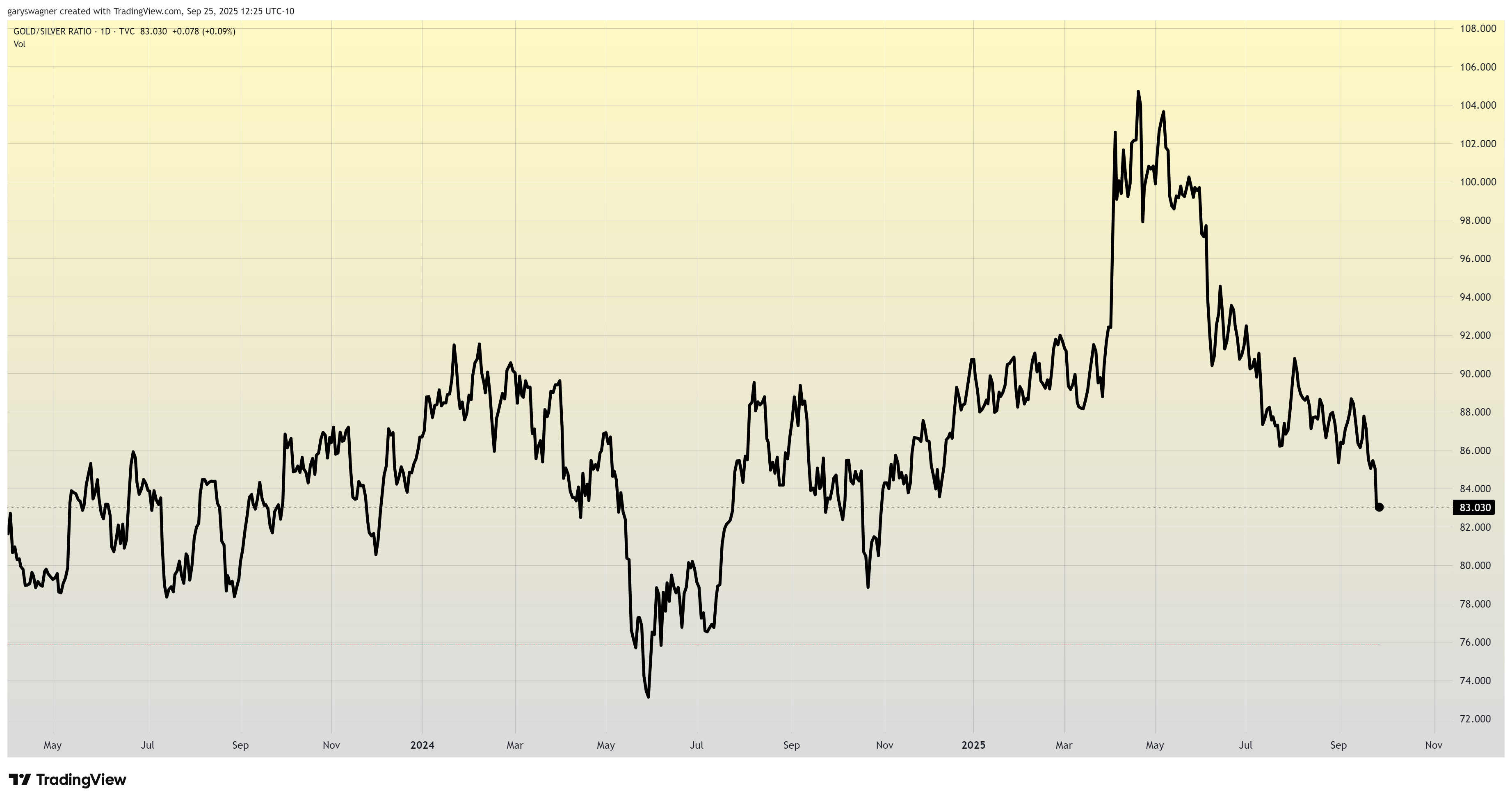

We have long been expecting silver to catch up to gold, and it recently has begun to close the gap. The gold/silver ratio dropped by 3% today now sitting at 82.89 closing at its lowest value so far in 2025. The ratio which compares how many ounces of silver are required to purchase an ounce of gold hit its lowest level on record back in 2011, during the last occurrence of silver breaking above $40.

That low in the gold/silver ratio was reached in early May of 2011 and came in at an astonishing 31.07. More recently the ratio made a low of 62 back in 2021. Realize that just a small change in the ratio could represent a huge move in either gold or silver as they tend to move in tandem to the upside or downside, still the gold/silver ratio paints a picture that gold has been overvalued or more likely that silver has been undervalued for some time. Our target for silver prices has been and remains $60 by the end of 2025.

Wishing you as always good trading,

Gary S. Wagner - Executive Producer